Henan Billions announced that USD1.34

billion for acquisition of Sichuan Lomon was in place in late Sept. 2016, and

that it would materially proceed the acquisition based on the sum. With the acquisition

funds being in place, Henan Billions is expected to become the first global TiO2 giant in China, according to analyst CCM.

Source: Bing

Acquisition

funds of Henan Billions is in place

In late Sept. 2016, Henan Billions Chemicals Co., Ltd. (Henan Billions)

announced that a sum of USD1.34 billion aimed at being raised in the 2015

private placement, was in place, and that the fund would be used to proceed the

acquisition of Sichuan Lomon Titanium Co., Ltd. (Sichuan Lomon) materially.

In order to maintain the “stock corporation” of Sichuan Lomon, Henan

Billions plans to:

1. Input about USD1.34 billion in acquiring

1.20 billion shares (= 99.99% of the total) of Sichuan Lomon. Specifically,

USD537.25 million will be paid to Li Jiaquan, president of Sichuan Lomon

Corporation (Lomon Corporation) for 480 million shares, USD360.82 million to

Lomon Corporation for 322.36 million shares and USD444.93 million to Tibet

Lomon Investment Co., Ltd. for 397.52 million shares.

2. Use about USD134.31 thousand to increase capital in its fully-owned

subsidiary Jiaozuo Xintai Resource Comprehensive Use Co., Ltd. (Xintai

Resource). Then Xintai Resource will use this fund to acquire 120 thousand

shares (= 0.01% of the total) from Lomon Corporation. Reportedly they have

already signed supplement agreements accordingly.

From this acquisition, Henan Billions will directly hold 99.99% of shares in

Sichuan Lomon, and via its Xintai Resource, will indirectly hold the rest 0.01%

stake. That is to say, Sichuan Lomon will become a stock corporation controlled

jointly by Henan Billions and its subsidiary.

“In light of Sichuan Lomon’s profitability

which is second to none in China’s TiO2 industry, Henan Billions, following the

full receipt of fund, will accelerate its acquisition,” stated Dean Wu, editor

of Titanium Dioxide China Monthly Report, CCM.

“Evidently, Sichuan Lomon’s excellent

financial performance will contribute largely to Henan Billions’ combined

figures,” Dean said.

Henan

Billions sees in Sichuan Lomon’s good performance in TiO2 industry

In 2015 when domestic TiO2 business fell

into historic trough, Sichuan Lomon still made net profit of USD94.32 million,

far beyond USD16.57 million of Henan Billions.

However, Henan Billions still maintained

its leading role compared to most of TiO2 manufacturers in China, such as CNNC

Hua Yuan Titanium Dioxide Co., Ltd. and Anhui Annada Titanium Industry Co.,

Ltd. which made net loss of USD18.80 million and USD20.59 million respectively.

This year, 2016, saw 10-round price rises in TiO2 price. This certainly is good

for Sichuan Lomon to make more profits.

On 14 Sept., 2016, Henan Billions and Sichuan

Lomon announced rutile TiO2 price hikes: +USD74.87/t for domestic clients and

+USD50/t for foreign ones. This signals the 10th round of price rises in China

this year.

Prior to this, in early Sept., key

manufacturers, such as Shandong Doguide Group Co., Ltd. (Shandong Doguide),

Jilin GPRO Titanium Industry Co., Ltd. and Jinan Yuxing Chemical Co., Ltd., had

already raised their prices.

Following this, the price of rutile TiO2

now stands at USD673.81/t, up by nearly 50% over early 2016.

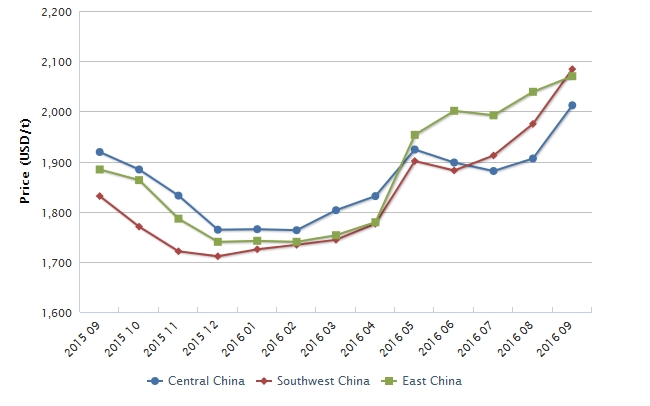

Ex-works

price of rutile TiO2 in China, Sept. 2015-Sept. 2016

Source:

CCM

“That’s to say, if Henan Billions speeds up

the acquisition even one minute earlier, it will have more positive financial

figures in its consolidated financial statements. Remarkable financial data and

high profits, undoubtedly, are short-run results strongly expected by Henan

Billions from this acquisition,” said Dean.

Acquisition

is beneficial to TiO2 industry in China

In view of market competitiveness, the pros

of this acquisition will outweigh the cons provided the acquisition is finished

as early as possible.

An unshakeable TiO2 “monolith” will have

been forged in China following the merger of Henan Billions and Sichuan Lomon.

Particularly against the backdrop of the continually increasing TiO2 price,

having the absolute say on price is of course of great importance.

Moreover, Sichuan Lomon’s advantage in

terms of minerals resources will be made use of to a larger extent, even if

both companies choose to maintain independent business operations at first

following the acquisition. Both enterprises will also be able to complement

each other in terms of technological resources and sales channels.

“Take a step back, even if China’s TiO2 business does not maintain its upturn

in 2017, and prices decline significantly, Henan Billions will have no need to

take the risks brought by acquisition of Sichuan Lomon,” stated Dean.

In May 2015, when Henan Billions officially

announced they were to acquire Sichuan Lomon, the latter ever made promises

regarding its financial performance: it predicted it would make a net profit of

USD104.47million in 2015, USD134.31 million in 2016, and USD164.16 million in

2017.

If there were discrepancies, the company

said, they would be made up by original shareholders.

In 2015, Henan Billions received USD10.14

million in compensation from Sichuan Lomon, which was then used by Henan

Billions to supplement the working capital of Sichuan Lomon.

“It is believed that Henan Billions will spare

no efforts to speed up the acquisition because it is for sure the biggest

gainer in this acquisition,” Dean added.

About CCM:

CCM is the

leading market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include Monsanto,

DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more

information about CCM, please visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.